A very different approach is emerging between Australia and China’s treatment of jobs and industries providing goods and services for environmental protection.

In Australia, major investors are reported to be planning for the impact if the Coalition wins power, axes the carbon price and dismantles the clean energy finance system. They expect private funding would be directed away from large-scale renewable power – starving the sector of capital – due to regulatory uncertainty and a lack of solid returns.

In stark contrast, China recently announced it will elevate environmental protection to a “pillar industry” that would receive government support in the form of tax breaks and subsidies to tackle dire pollution. There are staggering amounts of money involved.

China has vowed to raise the total output of environmental protection industries to 4.5 trillion yuan (US$730 billion) by 2015, an average annual increase of 15%. To put that in some sort of perspective, that is equivalent to nearly 9% of China’s GDP in 2012. It is equivalent to nearly 50% of Australia’s GDP in 2012.

On improving air quality alone, China says it will spend US$275 billion over the next five years. That’s roughly twice the size of its annual defense budget. The Economist points out that even by Chinese standards this is an enormous sum.

A missing pillar in election policies

Coincidentally, economic pillars are the “it” metaphor in Australian politics. In this election both the Coalition and Labor have built their economic policies around pillars. The Coalition has five and the Labor Party has seven.

As the Coalition looks likely to form the next government, let’s concentrate on the five economic pillars in its policy platform. They are manufacturing, advanced services, agriculture exports, education and research, and mining.

You won’t find any direct reference to the environmental protection industry in the economic pillars of the Coalition policy.

It might be hiding in “advanced services” but the Coalition’s policy does not mention it. Advanced services is referred to as a “highly diversified sector” and particular mention is made of financial services, health services, engineering and architectural services.

The 19th of 21 policy themes in the Coalition’s policies is “delivering a cleaner and more sustainable environment”. This emphasizes the benefits of direct action on climate change rather than the carbon tax, a Green Army, and creating a one-stop-shop for environmental approvals.

Strewn throughout the Coalition’s policies are calls to reduce regulation and constraints on business, particularly the carbon tax and the mining tax.

Overall, the clear impression is that the Coalition views environmental protection as a constraint on an industry that should be minimised – like trips to the dentist – rather than a business opportunity in its own right.

A pillar or the whole foundation?

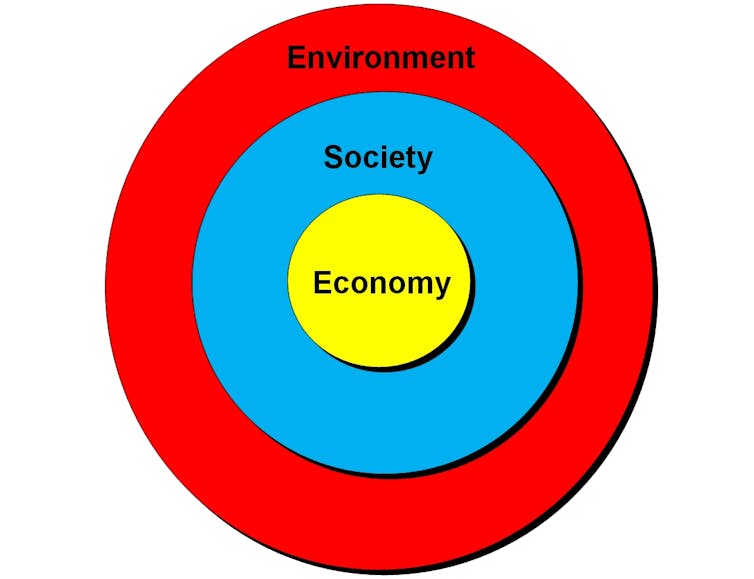

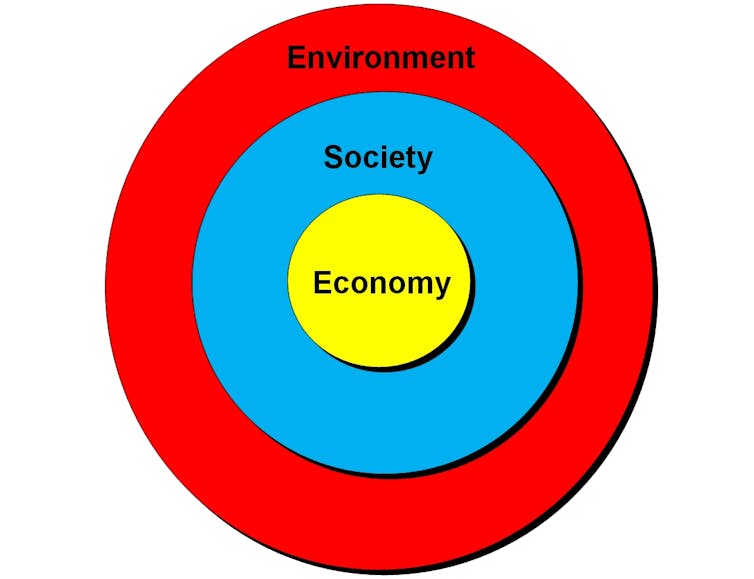

Thinking of environmental protection as an industry in its own right is innovative but perhaps it misses the bigger point that the whole economy depends upon it.

As the late US senator, Gaylord Nelson famously said, “The economy is a wholly owned subsidiary of the environment, not the other way around.”

Rather than think of environmental protection as an industry competing with other industry sectors and other social goals, we should think of it as the foundation of all of our economic and social goals.

When speaking as a teacher to classes on environmental law, a metaphor that I like to use is of a tree where social and economic goals like jobs and housing are the fruit we aim for and education, good governance and justice, and a healthy environment are the roots that sustain the tree.

When we think of environmental protection as the foundation or root sustaining social and economic goals such as jobs, housing, peace and security, and public health, we avoid the common and arid dichotomy of jobs versus the environment.

Still, the Chinese approach of recognizing environmental protection as an industry has the benefit of saying clearly that there are jobs in it. Can we learn from that? Can we make the environmental protection industry a major job creator and export earner?

The easiest way for the Coalition to incorporate this approach within its existing policy framework would be for it to expressly recognize Australia’s environmental protection industry within its economic pillar of “advanced services”.

An incoming Coalition government could promote trade with China in the environmental protection industry to build Australia’s exports into the massive business opportunity that China’s new policy represents.

Linking “environmental protection” and “industry” is an idea that is likely to win support across the political spectrum.

This article originally appeared on The Conversation website. By Chris McGrath